3 EASY, Predictable, and Reliable Forex Candlestick Patterns

How to Make Money Trading Forex During the 2020 Recession

April 8, 2020

TIP: Relative Strength Index (RSI Indicator)

April 8, 2020You Can Trade to Profit Like a Pro EVEN if You’re a Beginner & WHY they work so well.

I’ve been trading for years now, I’ve lost a lot of money and made enough money to keep me in the game and excited to show up to “work” the next day. Now, this post isn’t about me. It’s about YOU and helping YOU make money as a Forex Trader.

Whether you’re an absolute beginner or an intermediate trader and popped your “Forex cherry” by placing some trades here and there, I want to share with you 3 But before we begin, I want you to make me a few promises; ones that I KNOW you’re going to have a tough time keeping.

Are you ready?

The first promise I want you to make is that you will use these strategies ALONE and be disciplined with that. Why? Because if you “stack” strategies by applying multiple indicators, you will usually get mixed signals and it will confuse you

The second promise I want you to make is that you will apply RUTHLESS Discipline in your setting your Take-Profit Targets and Stop-Losses. Because here’s the reality of trading Forex: Although these candlestick patterns will provide reliable data and predictable targets, they won’t always be right. You will lose money, the goal is just to help you make more money than you lose and you can ONLY do that when you have a good Risk/Reward Ratio and set tight stops.

PS. If you don’t know how to Identify a good Entry Point and Set a Reward to Risk Ratio yet, You Can Click Here to Check out an article that I wrote to help you do that.

This stuff isn’t theory, and if you follow the two above rules and trade with discipline, (I.E. Don’t FOMO into trades and stick to a trade once you’ve entered a portion with your Take-profit + Stop-loss in place) you’ll start to recognize that making money as a trader isn’t as hard as everyone makes it out to be. The hardest thing isn’t getting proper “signals” or setting your targets to earn money, the hardest thing a trader faces is staying disciplined and unemotional.

The final thing, By now I’m assuming that you have a fundamental understanding of Timeframes and Candlesticks. You understand what it means when a candlestick is either blue or red and what it means when it has a long body, or a long wick or a small body and small wick, or any variations above. So with that said, let’s share the 3 most common & easy to spot candlestick patterns that are almost always guaranteed to lead you to victory and profits. Each of the examples here will refer to the daily time-frames because remember, The Larger the Time Frame, the More Accurate the Signal Becomes.

1. Tweezer Candlestick Pattern

The reason that this pattern is called a “Tweezer” is that it resembles a pair of tweezers where the body is long and the needles on it are sharp and even. Tweezer Patterns can come in the form of a “Tweezer Top” meaning as a strong signal that the upwards momentum has ended and a “Tweezer Bottom” signals the opposite; a signal that there’s no more selling pressure.

Tweezer Bottom:

The reason this pattern points to a reliable bottom (at least for a small swing move) is that the price failed to move any lower over two consecutive days. In other words, this becomes a strong indicator that for the time being, the pair doesn’t want to move any lower and only wants to move higher.

Tweezer Top:

This pattern points to the top of a current move because the price wicked to the same place over two days and ends with a red candle, sometimes even larger than the first day’s green candle.

2. Morning & Evening Star Patterns

When was the last time you woke up at the butt-crack of dawn, just early enough to catch the sunrise? I know for me, it’s been a while, my schedule is wack with computer screens in my face all the time. Well, the sun rises, and in the case of a Morning star, the price was at it’s “horizon” and now moves up. This pattern indicates that you should long the market. The evening star implies the opposite, the sun is going down so you can see the stars. Evening implying you should short the market.

Here I’ll provide two examples you should take a look at and get familiar with on daily charts.

Morning Star Pattern:

This pattern is marked by one bearish or red candle going down, a second candle, which looks more like a Doji, and typically rises just above the 1st candle, and then is followed up by a third candle that’s largely bullish or green. Another pattern that is closely related or mistaken for this one is the “bullish abandoned baby.”

Evening Star Pattern:

As I explained up above, this pattern is Bearish and points to the fact that we’ve probably reached the top of a small swing move. This is a 3 candle pattern. The 4th candle after the 3rd day (which is bearish) should be a good place to short the market. Also referred to as a “bearish abandoned baby.”

3. Bullish and Bearish Engulfing Patterns

This one is pretty self- explanatory and in my opinion really easy to trade and spot because it means one candle “engulfs” or is larger than the other. Almost like a BIG shadow that overpowers a little boy and scares him into submission.

Bullish Engulfing:

A bullish engulfing candle pattern is a large red, full-bodied candle that is smaller than the green, full-bodied candle that comes after it.

Bearish Engulfing

A bearish engulfing candle pattern is a large green, full-bodied candle that is smaller than the red, full-bodied candle that comes after it.

How to set Take-Profits and Stop-Losses for all of these patterns.

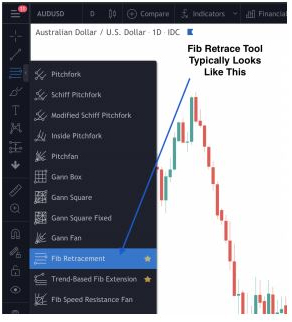

In the 3 examples above, we shared how to identify a reversal in the trend, but how exactly do we identify the target or where the price will go to so you can take your profits? There are multiple ways to do this, but I will recommend one of the simplest ways you can do this by using the “Fibonacci Retracement Tool.”

This tool comes stock in most “charting platforms,” and is a common tool based on “Universal Patterns” in nature, math and science. If you want to learn more about it, just google “Fibonacci in Trading.” In the meantime, I’m just going to share a few examples of how you can use this tool to effectively find a “take profit” zone when you’ve identified a top or bottom in any of these candlestick patterns.

So I hope this was helpful, If you have any advice you’d like to share, or need help learning more, just be sure to drop a comment below or reach out in the contact page on this site.