How to Spot a Fake Forex “Guru” On Social Media

Here’s Your 5-Part Checklist That Will Help ANY Forex Trader Stay Profitable

March 5, 2020

The Art of Using Artificial Intelligence (A.I.) To Trade Forex

March 12, 2020and What You Can Do to Protect Yourself from Online Forex Scammers:

There’s nothing new about con-artists. Since the beginning of recorded history, there have been, and always will be scammers, schemers, liars, cheats, and thieves. But now, more than ever with the invention of the internet, social media and endless loads of information plus misinformation,it can be difficult to sift through it all and tell what’s real.

These tools seem to make the problem worse. Social Media Forex “Gurus” have come out of the woodworks to steal your money and then teach you how to blow your live account through subpar or mediocre training that looks good in theory, but doesn’t work in reality. I’ve even noticed that the majority of these “so-called traders” speak with the authority which helps them to sell their programs, because “they must know what they’re talking about, they’re so confident.” Don’t fall for their traps.

And don’t buy into their “programs” and “coaching” which range from selling signals to “forex bots” to groups and personal mentorship which they charge exorbitant amounts for.

So how do you know a self-proclaimed social-media Forex “guru” is full of shit? Look no further because in this short little article I’ll be sharing 6 different ways you can spot a Fake Forex Guru so you can avoid being scammed by them.

1. They ONLY Show Their Winning Trades with Lot Sizes FAR Too Big For Their Account.

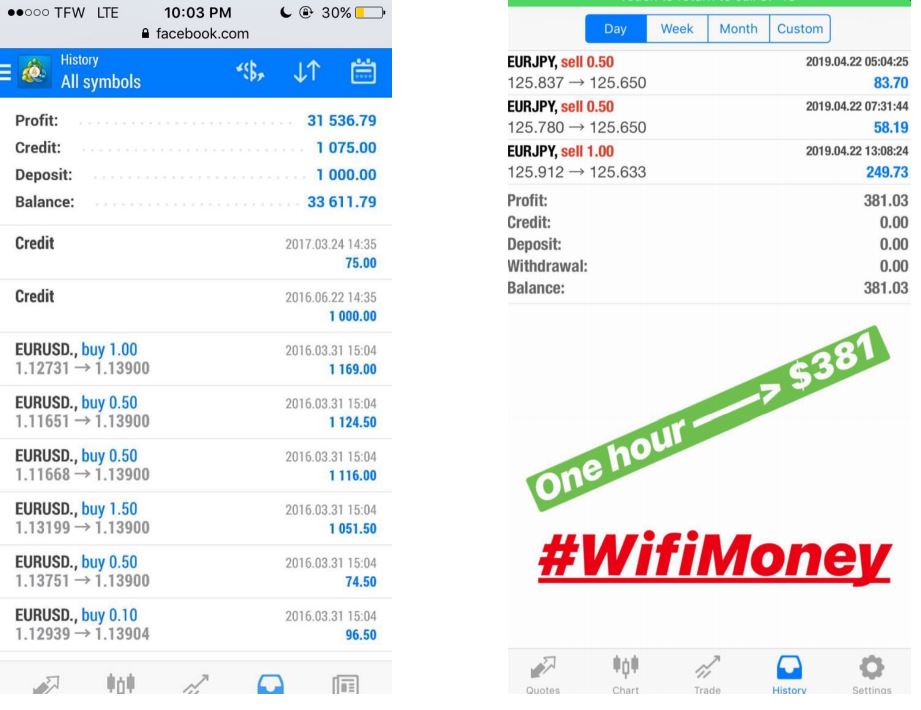

I’ve seen it hundreds of times and probably will thousands more. Where a Social Media Forex Trader promotes their profits through the classic screenshot of their highly profitable account with high Lot sizes and trades that range into the hundreds and I’ve even seen thousands of dollars.

Don’t get me wrong, some people trade standard lot sizes and take profit of thousands per day, but the people who do that are usually worth more money than it’s worth to sell a 1k program and then take the time to advertise it all day.

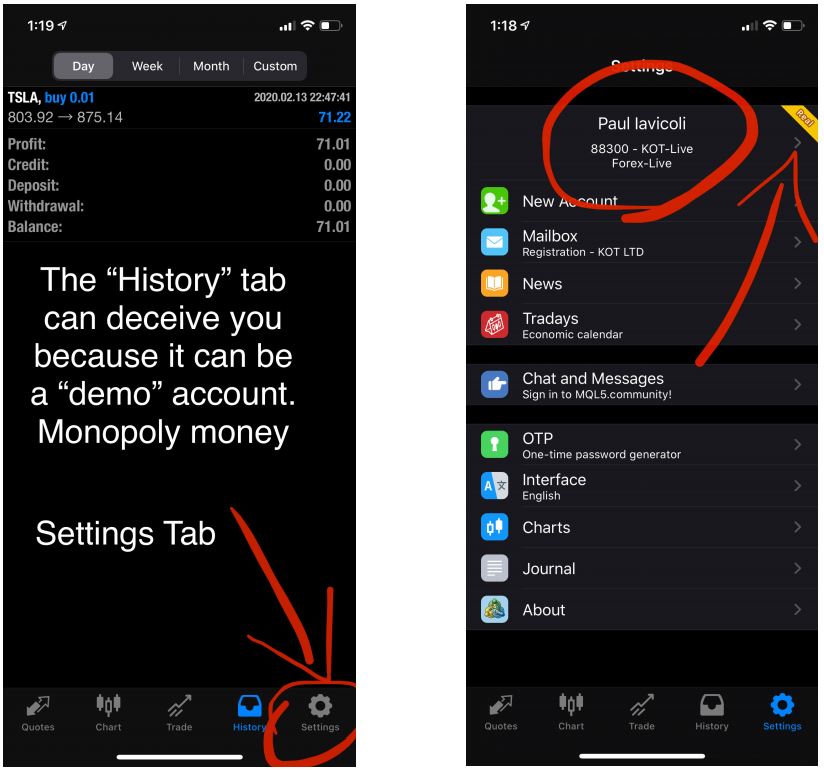

2. They Post Screenshots But Don’t Show Their Name or Verify if it’s a “REAL” Account

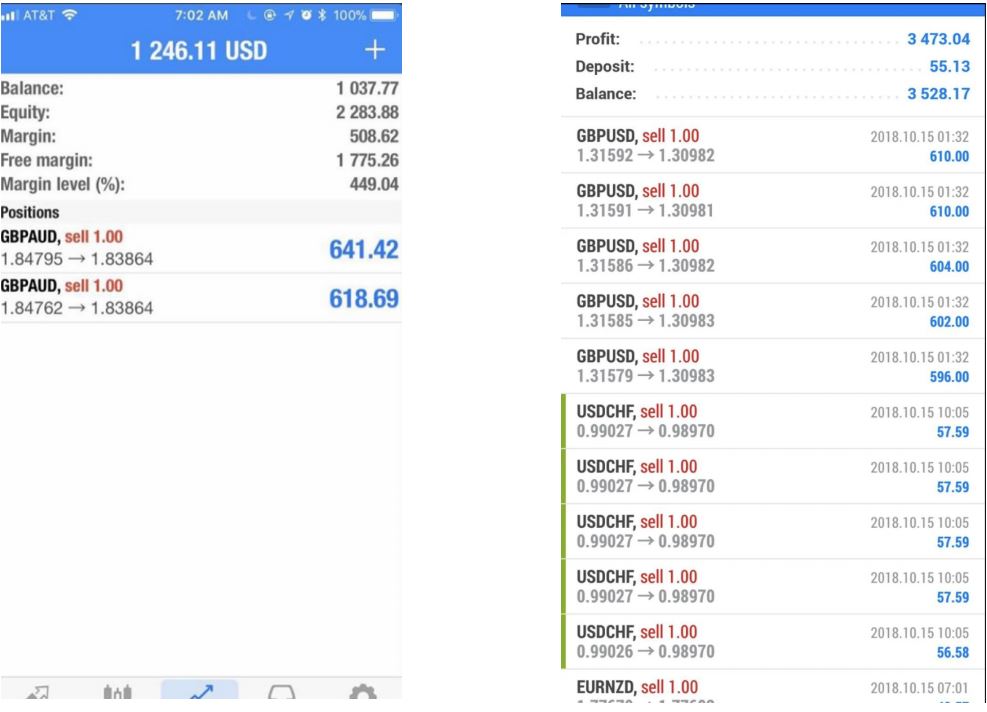

When they do get around to sharing numbers from their trades, they typically look something like this…

Typically they try and show off Large numbers in the blue (profit) and large account balances to show how “rich” they are from trading and being “right” more than they are “wrong.”

If someone is trying to sell you into their program, ask them to verify their account like this.

3. They can’t prove their track record for more than 6 months to 1 year.

Do they have statements about actual bank account deposits? Did they link their brokerage account to an analytical tracker like MyFXBook or FXBlue?

Are they showing you their history as a trader or just a winning week/streak? Do they feel comfortable to share their overall account growth and losses?

To Date: I haven’t met a single professional; trader that still doesn’t lose trades (sometimes upwards of 50%+) but it’s not about how many trades they win or lose, it’s about how they manage risk and only enter trades that have a higher rate of reward than they do risk.

For more on setting the right Risk to Reward Ratio Click Here

4. They Appeal to Your “Make a lot of Money Fast and Easy” Desires.

Nobody wants to get rich slow. These people know that, and although they’re not highly intelligent, they’re also not dumb. They’re salesmen. Salesmen and Fake Gurus rely on getting people to buy into urgency and scarcity. They try to make the sale quickly because most folks want money quickly before they’re found out to be frauds.

In other words, if you feel like you’re being “sold” or like you might “miss out” on their “amazing offer” think twice and do your research on the trader.

5. They Rely on Enticing Images and the Attractive Side of the Business.

The biggest thing you should know about social media forex fakers is that they are in business. But they aren’t in the business of trading. they’re in the business of selling you a dream without sharing the downsides of the “dream” they’re selling you.

Every business has it’s pros and cons and to share with the world only the “pros” of something is not only dishonest but outright bullshit. Kind of like social media, everyone is busy sharing their “highlight reel” but not their “behind the scenes.”

Don’t fall for the hype, a post about a fancy car they rented and pretend to own, mansions, women, big numbers and “cool lifestyles.” It’s all marketing and noise.

Real traders don’t typically live luxurious lifestyles where they travel every other day. Real traders spend more time alone, in front of the computer, looking for entries and exits. Its a game of patience, practice, and persistence. One most marketer and “gurus” aren’t willing to play.

Then Who Do You Follow?

When all else fails and you feel unsure, just consult Google for Youtube. 9 Times out of 10 you can get the information you’re looking for, for free. And worst-case scenario, if you’re still unsure about someone, ask yourself the question why?

Why is this person taking the time to train me? What’s in it for them? Have they truly had a successful career as a Forex Trader? For how many years? and if so, what’s their reason for training people now? Most folks selling the programs don’t even have a track record of more than 1 year and realistically, it takes 2 – 3 years to even be profitable as a Forex Trader.

Don’t believe me? Just go find a real pro and ask them. The last thing, if it seems too good to be true without a real explanation, it usually is. And in financial markets, even more so.