The Most Important Stuff You Should Know About Forex

Daily Trading Habits of Successful Forex Traders:

January 10, 2020

Here’s a List of the Different Forex Trading Styles:

February 3, 2020Before You Ever Place Your First Live Trade Which Most Newbie Screw Up On Or Fail To Do

Easily one of the most overwhelming you face as a beginning Forex Trader is deciding on what your trading style will be, how big your lot sizes should be and how long you should remain in trades and when you should exit. Well, in this post, I aim to help you get more clear on those hesitations, so you know how to move forward as a Forex Trader and can adopt a Daily Method of Operation. At this point, I’m assuming you want to earn a bare minimum a part-time income and the only way to do that is by showing up in some form or manner daily.

Now before I dive into the styles of trading, it’s important to recognize that there are many ways up the mountain just as there are many ways to skin a cat or make money. Can two people get to the top of the mountain by taking two different routes? The answer is of course. So in that same vein of thinking, it’s also possible to earn the same level of income by trading in many different ways.

Define Your Income Goal

The first task you have to undertake (and usually the easiest of the bunch) is choosing which mountain you want to climb. Some mountains are much taller than others and some people are a bit more ambitious than the others. You see, the major reason most people never make it anywhere is simply that they never point to one mountain or another and say, “I will climb that one.”

So they sit about twiddling their thumbs expecting to somehow arrive at the top of a mountain they never started climbing. You get the picture. Yes, a decision and commitment are essential here, I would say to the point that it’s almost the most important decision you make. Because once you know the destination, and commit to it, you will inevitably, eventually, arrive.

So what does that look like for you? Are you ambitious? Realistic? Don’t need much to be happy? Want to supplement your car payment? Your Mortgage? Enough money to travel the world? Feed your kids? What is it? How much do you need? Write it down. $500 monthly? Or $5,000 monthly? The amount isn’t important here, what’s important is committing fully to the amount you set. It’s also important to note that time is of no issue here. You can just as easily make 5k in the same amount of time it takes to make 500, but inevitably, you will need more money to play with if your amount is larger.

Define Your Risk Adversity

The first question I ask a trader that I’m mentoring, especially if they’re a beginner is: “How much are you willing to lose?” The answer they give is usually the amount I tell them to start with because if they lose it, it becomes a learning experience but not an expensive one. I also always tell people to start trading with a live account. It’s the fastest (and believe it or not) safest way to learn. Most “experts” will tell you to start with a demo account, but I advise against it.

Here’s my reasoning, If you start winning trades on a demo account using poor risk management practices, you may get a bit cocky and think you can just as easily replicate it in real trades. You have the evidence to prove it too. This is where most beginning Forex traders get a bit cocky and start placing bets that are far too large for their account and within a few weeks to a month, they almost always blow their account

So you might as well start with a live account, with real money on the line and develop good practices from the get-go. So what are you willing to lose? Start there. Then do the math, what percentage of your account are you willing to risk in every live trade? If you particularly risk adverse, you can risk up to 5% of your entire account in a single trade, although I don’t recommend it. Most professionals will advise you never to risk more than 2% of your account balance. Here’s how that should look.

$1000 X .02 = $20

$1000 X .05 = $50

$1500 X .03 = $45

So let’s just say, for the sake of this example, you start an account with $1,000 and only want to risk 2% of the entire account every trade. That means you’re willing to risk $20. But what are you risking $20 to make in return?

Know-How to Set Your Risk to Reward Ratio:

This is the part where you should understand what a Risk/Reward Ratio, which is exactly what we described. “How much are you willing to risk to make a better return.” If you do this part right, it makes it virtually impossible to lose money over the long haul if you stay disciplined about your R/R Ratio (risk/reward). The biggest mistake novice traders make is that they start trading bigger and bigger numbers without ever thinking of the consequences when a trade goes bad.

What having a set R/R ratio does is that it removes the true risk of losing money in the overall account while at the same time giving you leeway to lose more trades than you win and still come out making money.

Back to the example. Let’s say you’re looking for will risk $20 in the hopes that you return $40. If you bet right, then you make $40 bucks and if your bet is wrong, you only lose $20 bucks. That’s a 2/1 ratio. For every 3 trades you take, you can win 1 (+40) and lose two (-40) and still break even. Now, what if you want a 3/1 Ratio on the same account size? That would mean you’re looking for trade set-ups that yield $60 bucks while only risking $20. You could be right about where the market is moving once and be wrong 3 times there-after and still break even.

Are you starting to see the safety net this provides when you’re just starting? You could essentially be wrong about the market most of the 66% – 75% of the time and still break even, anything better is the icing on the cake.

How to Find a Good Trade Set-Up:

So how do you find these types of high R/R ratios? Well, there are many ways we won’t cover here using different technical analysis and indicators. I’ll just aim to show you one method that is extremely simple to follow and apply, plus it’s reliable. This method relies solely on support and resistance lines in a Flat or Parallel Channel.

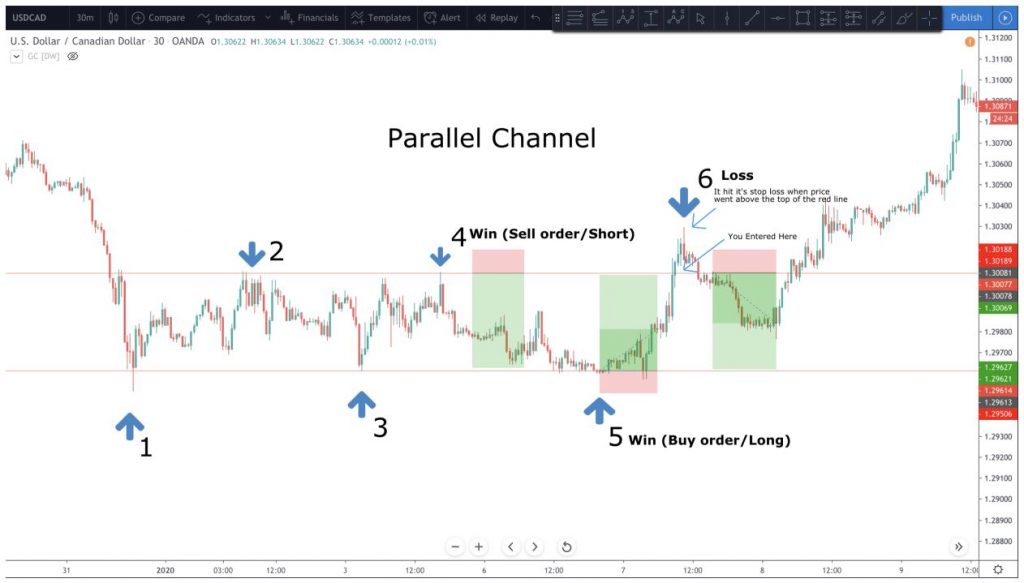

In the first example, we have a 30 min chart (each candlestick represents 30 minutes of market movement) of the US Dollar Vs The Canadian Dollar (USD/CAD)

And in this example, I have pointed to 6 touches in the channels and 3 potential opportunities to place trades with good opportunities for an R/R of more than 2/1. These are trade set/ups at a 4/1 ratio.

You’ll notice we didn’t enter in the first 3 touches of the channel because up until then, there was no channel, but after the third twitch down at the bottom, it was likely that the trend channel would hold so we entered at the 4th touch at the top (denoted 4). This was a short or sell order to the downside. The bet was that point 5 would touch where point 3 was. That was correct. The market didn’t continue moving up once it hit point 4 it started moving back down in alignment with what we assumed would happen.

If point 4 held up as a resistance, it was likely to touchdown at point 5 which had now become support. Taking a long position at point 5 would have made you 4 times what you risked. Now at point 6, we encounter our first loss, you can see that the candlesticks spiked to above the level of the red line on the far right and never even touched the bottom of the channel anyway before making its next move up.

So all in all, if your R/R Ratio here was 4/1 and you risked $20 bucks to make $80, winning two of the 3 trades entered, you made $140 bucks, ($80 + $80 – $20 = $140). Your $1,000 account is now sitting at a pretty $1,140. The new amount you’re able to risk at 2% of the account is $22.8

Onto Example Two:

In this case, we have two channels on the 30 min chart of the Australian Dollar Vs US Dollar (AUDUSD)

The same psychology and strategy apply here. You probably wouldn’t enter until Point 4 and would make money through point 6 and lose on point 7. The notes inside the image also note that the old resistance line (what the price action failed to break out above in the first channel) now becomes the support in the 2nd channel. Now that we’ve had 3 touches from top to bottom and back up to the top, I would be looking to enter at the future point 4 at .68808 and I would Long the market to .69097.

Final Note

In all cases, it’s important to note that just because you’re good with technical analysis, doesn’t mean you’re a good trader. What makes a good trader? Risk management and emotional control. Allowing your trades and positions to play out even if you’re in the negative because you will inevitably lose trades and be wrong a lot of the time. Being wrong isn’t bad. Not holding to your guns and ignoring your rules is.

So 3 things you must do to start trading like the pros do is set an income goal whether its a total amount or monthly amount. Commit to a certain level of risk/adversity and don’t stray from it. The third and final thing I didn’t add because we didn’t need to write up a novel here is to practice daily. Look for set-ups daily and don’t get impatient, if you don’t see any opportunities to enter, just don’t. It’s better not to take trades at all than to look for trades that aren’t there, that will get you killed.

If you want to dive further into becoming a more seasoned Forex Trader Download my newly released book: In The Money – Forex Trading Secrets From a High School Dropout by Clicking Here