Your #1 Enemy If You’re a Forex Trader

- Home

- Blog

- Uncategorized

- Your #1 Enemy If You’re a Forex Trader

This sneaky robber baron has been stealing from you for months and maybe e years + how to protect yourself so you no longer forfeit easy money to these thieves.

I want to be BRUTALLY honest with you…

“They needed fools; only fools would take the other side of their trades.”

Above I have a little excerpt from the #1 New York Times bestseller & movie, “The Big Short.” And although this particular line relates to Bond trading (in the housing markets, which made the economy crash in 2008) it applies equally across the board in all markets.

But to break it down further, let’s dive into the process of how you make money in any market where you bet on companies, economies, stocks or bonds. To make money in the stock market

for instance, you need 4 entities. A company that’s public (like Apple, or Tesla), A intermediary, like a broker who can facilitate the trade, a buyer and a seller. The goal of the process being that you (as a buyer) want to make money by owning a piece of a company.

So let’s just say you take a look at Apple stock, and see that it’s currently trading for $230 per share. You like that price and think it’s a good buy because you believe it will climb up in price within the next year. You buy one share. But exactly how do you buy it? Well, you need to open an account with a brokerage, kind of a like a “trader’s bank account,” who has access to a list of sellers (or people who already own Apple stock) and want to sell it at the price you’re seeking to buy it at.

The more buyers and sellers a brokerage has access to, the more liquidity a market will have. Liquidity simply means money flow; kind of like a river. The more “liquid” a market is, the

easier it will be to find a seller or a buyer for what you ask. On the other end of the spectrum, “lack of liquidity” in a market means no buyers for a specific price and no sellers for a specific price.

Example: If you took a bunch of fairground stuffed animals into a desert where only 3 people live and tried to sell them. What if those two people aren’t wanting to buy what you have to offer

at the prices you ask? You’re stuck with a bunch of stuffed animals, no demand and so by the laws of supply & demand, you stuffed animals are worth less because nobody is willing to buy

them. So if you truly wanted to sell those stuffed animals, you would have to continue to drop the price until those 3 people are willing to pay you money for them. Buyers (or lack thereof)

dictate the true value of your stuffed animals in this scenario.

In other words, for every buyer, there needs to be a seller, and for every trader, there needs to be a brokerage with a decent amount of liquidity. These are what make markets move and they

typically have an intermediary known as a “broker.”

Know Your Enemy

Now, if you’re playing a game, then chances are you’re competing against somebody. Forex is a ZERO-SUM same. That mean’s when somebody wins, somebody else loses, and vice-versa. If

that’s true, then who exactly is on the winning side when you lose? I can virtually guarantee you it’s NOT some other Joe Schmoe in their sweatpants at their home office. No, think of this like you’re at the casino, who ALWAYS walks away in the profit? The House, the casino.

Who always loses? Those poor bloody folks who walk in with cash, hoping they’re the lucky ones today.

Would you like me to give you a face? Maybe even a few names, so you know who they are and then begin to understand how you’re constantly being robbed as a Forex Trader?

The True Winner In the Forex Markets + How To Beat Them.

BIG Banks. More specifically Interbank. What’s Interbank? A Cartel of Banks.

Think of typical drug cartels. If they war with each other, operations can take a major dip, their dealers die and they lose access to their customer. But if two drug cartels partner, it’s much easier to work around government (which is what they typically do). They get access to better routes and areas of trade.

Interbank is the same. It’s an agreement, arrangement or unified operation between specific banks. In other words, we can call this a banking cartel. When banks operate independently, they

compete with each other which hurts business and profits. when they operate together, they create a controlled environment where they consistently win and essentially never lose.

Still all of these banks are trying to make money and to make money, they need a sucker. Who’s the sucker going to be? YOU.

You and other “Spot Forex Traders.” People who fund an account and trade the Forex Markets.

Now, let me ask you a few questions:

Do you believe you’re smart enough to beat the banks at their own game?

• Do you think that each of these banks has enough money and resources to hire people smarter than you to make more money for them?

• Even if you’re smarter than the people these banks hire, is it possible they can outsmart you by sheer brainpower and numbers?

• Do you think that together they have enough money to move a market?

• Do you have that same amount of buying power?

If you played their game, over the long run, you will lose everytime, the question is how much do you want to lose?

You didn’t get into the Forex Markets to lose right? You came to make money.

Then what’s the solution? What if you didn’t sit down to play at their table? What if you played a different game? What if you let the other people in the Forex Markets get suckered into losing their money at the “casino” and you simply played at your tables?

You can and here’s how,

Understanding Brokers, Banks and Your Relation To Them

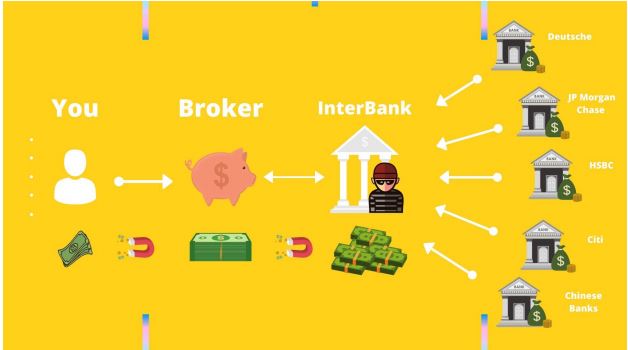

Okay first, you have to understand how this all works most simply. Things aren’t as simple as the graphic below but they will work close enough to the point that we work toward the solution.

So when you go to trade in the Forex Markets, First you need to fund a Brokerage account. This brokerage account is linked to the greater market, typically Interbank, which provides liquidity.

NOTE: Remember the example of liquidity above? We have money with a broker which facilitates your trades with big banks. Now, imagine millions of people worldwide funding brokerage accounts and trading, not against each other, but these banks.

Brokers are essentially middle men, they make money on fees and “spreads” from me and you while we typically lose our principle amount to the Big Banks. Starting to make sense? However, here’s what sucks, BOTH banks and Brokers are known to be dishonest.

At any point, brokers can “mess with your trades” or simply take off with your money because they operate in another country with more lenient laws, while banks can see the “order flow” of

trades. This means that banks know where the majority of traders like me and you are placing out bets. They know whether we think the market is going to go up or down.

So if a bank sees that 75% of small-time Forex Traders think the market is going to move down, they just toss a ton of money in to make the market go up which hits our stop loss, resulting in that very same 75% of traders to lose money.

But these banks are smarter than that. They know that if they always beat us and we’re always losing money, we simply won’t play anymore. So what they do is implement “The Blackjack

Theory.” They let us win just enough to get us hooked and thinking we’re smart. Then when we get confident and bet a lot, they move the market in the other direction causing us to blow our entire account.

Almost sounds impossible to beat the banks right? True, so then how do you make money in Forex at all.

Things You Can Do to Avoid Betting Against the Big Banks

John D Rockefeller once shared, “If you want to succeed you should strike out on new paths, rather than travel the worn paths of accepted success.”

True of all success, true of Forex trading. If everyone else is hanging out in the same pool, then it’s likely the banks are too. Why? More money to steal.

Instead, go hangout where all the Forex traders aren’t hanging out and you’re likely to avoid the Big Banks market manipulation as well.

One way to do this is to avoid trading the Major Pairs like:

EUR/USD

USD/JPY

GBP/USD

GBP/EUR

AUD/USD

USD/CAD

NZD/USD

EUR/JPY

And a few others which you can look up online under “Major Forex Pairs.” Chances are, if you’ve heard they’re good to trade because they “move a lot more,” then it’s more likely they banks are playing these markets and making the most money on them.

Instead, go find some “minor” or “exotic pairs” to trade, meaning, pairs that are traded less because they “move less” or come from emerging countries.

Pairs like:

CHF/JPY

NZD/JPY

GBP/CAD

EUR/TRY

USD/HKD

USD/MXN

AUD/MXN

And more. Google, “ Forex Minor and Exotic Pairs.”

The second thing you can do is avoid using the same indicators everyone else uses. Because if everyone else is using them, then that means everyone is getting the same “signals” and choosing to go long or short on a pair. If the majority of people are long on a marker, then the banks will probably go short because they have access to see information that you don’t.

To find out which indicators to avoid using as sole signals just google the term, “Most common Forex trading Indicators.” Sure, it’s good to get familiar with these indicators, but don’t use them alone, pair the common indicators with rarer ones.

The third and final thing you can do is Avoid Trading News.

Many traders will say they love trading news because they can make a lot of money on a swing.Those traders must be stupid or constantly losing.

Big Banks LOVE news too because they now have an excuse to move a market in either direction, violently, and at will. And to the typically Forex trader, they will see what happened and blame “a news event” when in reality, it was the banks that used a headline to pocket more dollars from unsuspecting traders.

My advice, keep a lookout on current news events from each pair and then just avoid being in live trades during those times.

There you have it, 3 things you can do to avoid getting bullied and robbed by Big Banks

1. Avoid Most Major Pairs (hanging where most traders hang). Trade Minor or Exotic Pairs

2. Use Different Indicators than everyone else.

3. DON’T Trade News Events.

If you follow those three pieces of advice and practice good risk management, you will inevitably be a more profitable Forex Trader over the long haul.