Examples That You May Lose Money Trading Forex

Your #1 Enemy If You’re a Forex Trader

April 9, 2020

3 Legendary Traders

May 1, 2020And what you can do to avoid blowing your trading account or paying for the other guy’s lunch

Most folks decide to get into the world of trading and Forex because they see the “upside potential.” In other words, they become enticed with the idea of making a lot of money to look at a few Forex Pairs, draw their lines, use some indicators, and press a few buttons.

It sounds attractive enough right? These very same people even romanticize how easy it can be to become rich trading Forex because they watched a few people on social media or a youtube ad “tout” about how much money they made in a short amount of time. I mean who doesn’t want “something for nothing?” We all do, it’s human nature. BUT, it’s equally important to remember that you’re only seeing ONE side of the story.

Remember, for every single winner, there is also a loser. And for every person making 1 million dollars on a trade, 100 losers lost 10,000 each. More money has been lost by amateur forex traders worldwide, per-year, than it probably cost to build New York City over the span of its entire history.

But that’s not enough context, is it?

A fella by the name of Marc posted this on Quora and it’s the best data I could gather as an estimate,

New York’s physical existence is made up of a bunch of very big components.Transportation infrastructure (roads, bridges, trains, and subways)

Other infrastructure (water supply, sewage system, power distribution, telecommunications distribution, …)

Buildings (residential, commercial, institutional)

There are about 6,000 miles of streets in New York City. Urban roads cost somewhere between $3 million and $5 million per mile, so replicating the roads would cost $30 billion.

Replicating the NYC subway system has been estimated to require about $1 trillion.

Bridges are expensive, but there aren’t that many of them. The Verrazano Narrows Bridge, built in 1964 for $320 million would cost about 8 times as much to build today if the cost went up with headline inflation since then, or about $2.6 billion. Let’s assume that the other bridges were all the same:

Brooklyn

Manhattan

Williamsburg

Queensborough

Triborough

Henry Hudson

George Washington

Whitestone

Throgs Neck

Verrazano Narrows

We’ll ignore the minor bridges across the Harlem River and the bridges between Staten Island and New Jersey (we’re lazy andit’s late at night). So $25 billion will replicate the major bridges.

There are a lot of buildings in New York. How much would it take to replace them? Office building construction in New York is

estimated to cost about $400 per square foot. Residential construction, if you exclude the land costs, runs about $300 per square foot.

Here’s an article {hyper-link} that suggests that there are about 600 million square feet of non-residential space and another 1,300 million square feet of residential space.

Thus replacing the homes and offices would total about $630 billion.

We still have the major distribution systems – water, electricity, communications, sewage. It’s hard to estimate the cost to replicate all of them because construction in existing cities is complex so a big piece of the cost is preventing harm, hence expensive review and permitting processes. Let’s throw in another $1 trillion for all of them.

The dominant costs are the subway system, the major distribution systems, and the residential and non-residential buildings – a total of about $2.6 trillion.

If we were building a replica of New York on a site that is currently unoccupied, it could be done faster and cheaper than building in place. How cheap? Hard to tell, but I’d bet you

could cut the cost in half. Call it $1.5 trillion.

Between 1.5 – 2.6 TRILLION to build NYC? Is that more or less than what you were thinking?

So how much money is transferred daily in the Forex Markets? 5.7 trillion according to the last major estimate. Now, most of that money movement is done by Big banks and institutional investors, but, I’m willing to bet that at least 1 trillion of that is done between smaller exchanges and individual investors or people like you.

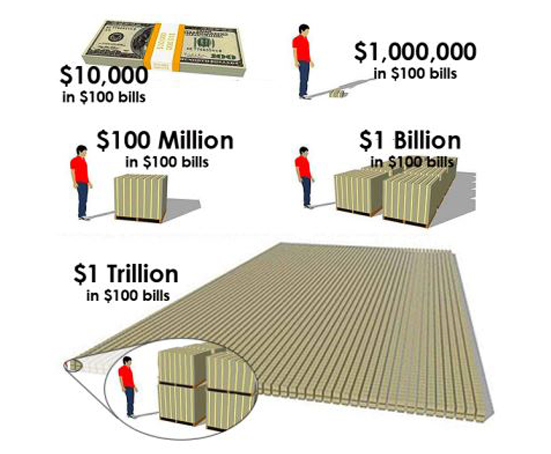

As a nation, we’re becoming more familiarized with the amount “trillion” because it’s thrown around by the federal government and media outlets these days, but just exactly how much is 1 trillion dollars.

Heres a photo for context:

In other words, in a single market year, at least 1 trillion of that money paid to the “big cats” is paid by none other than you, the small fish in a big, big pond.

Again, these are all rough estimates because we can’t just dive into someone else’s “pocketbooks” to check, and there is a lot of secrecy around the banks and institutions, but with enough context and incomplete information we can reasonably guess that across ALL trades made per year at least 1 trillion is lost by amateurs or even “good” traders by the standards of institutions.

So, if you remain an amateur, it’s likely you may get lucky a time a two, but over the long run, you will pay a VERY High Fee to have “romantic ideas” about the Forex markets. The fee you pay is paid in time, stress, and of course, money.

Don’t buy the other guy, or the bank lunch. You have your own family’s mouths to feed. You didn’t get into the world of Forex just to lose money, did you? So what’s the solution? How do you go from being the person who breaks even or loses their money to the person that’s constantly profitable even in their losses?

1. Make a Decision

To date, I haven’t met a single Forex trader who is profitable over a year or two that’s an amateur. And what I mean by an amateur is someone who trades irregular or as a hobby. You know? Someone who wants to get into the Forex markets to earn a couple of bucks and pay the bills? It just doesn’t happen. These folks are usually the ones who end up paying someone else’s bills.

If you want to earn a serious income as a Forex trader, then you need to get serious. You need to go through the right training and develop the right skills/muscles as quickly as you can to move from the amateur ranks to the pro ranks. Because the pros will beat an amateur every time and the banks will beat the pros.

So you might as well be good enough to beat the amateurs.

You need to go from “forex enthusiast” to “Investor” status. And that requires you to make a decision and then constant effort to back that decision. It will require you to make a few mistakes and lose some money along the way. But the sooner you gain those skills and get the valuable lessons, the sooner you’ll become a true investor and trader.

When I ask you the question, “What do you think an investor is?”

You will probably answer in a few different ways right. “Someone serious about making smart decisions to grow their money. Someone who manages their money to create more money. Someone who treats their investments like it’s a business and works hard to make sure that their business produces profits.”

When I think of an investor, I think of someone who trades with a plan and doesn’t allow their emotions to wreck their plan.

2. Create a Trading Plan For Yourself

Which leads me into the second point. If you want to be a profitable trader, you need to trade with a plan and stick to the plan. There’s an old phrase that goes, “Those who fail to plan, plan to fail” and in trading, this phrase rings even more true.

Another way to put it:

Trading without a plan is a lot like gambling, and gambling is a guaranteed way to lose your money

So what is a solid trading plan?

Well, I wish there was an easy answer for this one. Like a 3-step process or a 5-part rulebook, but there isn’t.

A trading plan differs by traders and their personalities. That’s why it’s so important to know yourself as a trader. Do you have a high risk tolerance? Do you make poor decisions when you’re angry or lose money? Also known as revenge trading. Do you consistently sit on the sidelines when you should be in a trade for fear that you might lose? Do you trade too much for fear of missing out?

The only way to learn more about yourself as a trader is to start trading. Then record in a journal or an online notepad about your tendencies, your trades, your wins, and losses. That journal will reveal a lot about you and you’ll begin to find a plan that works best for you.

As you progress, you can modify the plan when it doesn’t work and change the plan periodically to produce better results until you fine-tune it like you would a scope on a gun. Once it’s tuned, your trading will be far more accurate and you’ll hit the target more often. And by that, I don’t mean you’ll be right most of the time. You could be wrong 70% of the time and right 30% of the time and STILL be profitable.

A few things I would like to add that everyone should implement in their trading strategy though is proper risk management and pair mastery. Learn how to manage your risk and learn how to trade a specific set of pairs very well. Don’t try to trade them all because that would spread your expertise thin. Instead, go deep with a small group of pairs before you move onto every pair.

3. Show up consistently

The last real attribute of the Forex investor is that of consistency. This one has less to do with “skill” and far more to do with discipline. not much can be done for the trader with weak discipline. However, much can be accomplished by a mediocre trader with a lot of discipline.

Think of athletes. The best ones in the world are not the ones with a lot of talent. Sure, in the beginning, they do well and maybe even make it through college to the league. But once they’re in a pro league, their career tends to fizzle out. Why? because instead of relying on hard work (which requires discipline) they rely on talent.

And as the old saying goes, “hard work beats talent when talent doesn’t work hard.” True in sports, true in trading. If you want weak results, show up when you feel like it. If you want great results, show up consistently, even when you don’t feel like it.